Limited Purpose Fsa Contribution Limits 2025. Dependent care fsa plan year vs calendar year. For plans that allow a carryover of unused funds, the maximum amount of 2025 contributions that can roll over into 2025 is $640, a $30 increase over the 2025 rollover amount.

Texflex sm flexible spending account (fsa) contribution and carryover limits increasing in plan year 2025.

But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

2025 Limited Purpose Fsa Limits Betta Charlot, Also indexing upward is the maximum commuter contribution. Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

2025 Limited Purpose Fsa Limits Betta Charlot, You can only reimburse an expense from one of your accounts, not both. If you don’t use all the funds in your account, you may be able to roll over $640 to the next plan year if your employer allows it.

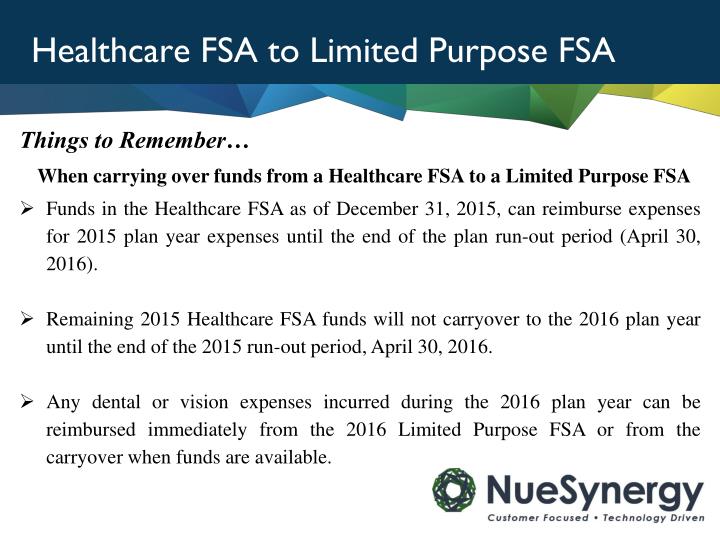

PPT Healthcare and Limited Purpose FSA Carryover PowerPoint, The limited purpose fsa limit for 2025 is $3,200 with a carryover limit of $640. For 2025, you can contribute up to $3,200 to an fsa.

FSA Limited Purpose YouTube, 22 apr 2025, 9:21 pm. But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

What is a Limited Purpose FSA? Lively, The amount of expenses you use. You can contribute a minimum annual amount of $120, up to a maximum annual amount of $3,050 in 2025.

Limited Purpose FSA Eligible Expense List, But again, no double dipping. Get the answers to all your lpfsa questions.

Limited Purpose FSA — Group Benefit Concepts, 2025 health fsa contribution limit. Review all claims and provide any required substantiation by december 31 each.

IRS Announces 2025 Contribution Limits for HSAs Ameriflex, For 2025, the irs contribution limits for health savings accounts (hsas) are $3,850 for individual coverage and $7,750 for family coverage. The fsa grace period extends through march 15, 2025.

Hsa Contributions 2025 Ardys Winnah, 1 to figure out how much to contribute, consider what you can afford to have deducted. Each year, the irs updates the maximum amount that an account holder can contribute into their healthcare flexible spending account (fsa), and the amount that eligible account holders are able to carry over to the following plan year.

Tabela Atualizado Irs 2025 Hsa Limit IMAGESEE, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. For 2025 benefit period, you must submit all reimbursement requests by march 31, 2025.

Each year, the irs updates the maximum amount that an account holder can contribute into their healthcare flexible spending account (fsa), and the amount that eligible account holders are able to carry over to the following plan year.